The year 2025 is turning out to be especially significant to the millions of US residents. Alaskans are also more than delighted by this year since they will finally receive the long-awaited stimulus payment of $1,702 that will bring them directinancial relief. Alaska is a state that has proudly stood out over decades by its own distinctive policy model, where the state shares a percentage of oil revenue to cwithitizens, which is called the Alaska Permanent Fund Dividend (PFD).

This is a policy method to have the good of both the state government and the ordinary people, whose wealth is to be shared with the natural resources. This timely financial aid of 1,702 stimulus checks will come at the right time to offer the support needed by the senior citizens, as well as the low-income families in 2025 20with25,to meet their daily needs, energy bills, and other requirements.

History of Alaska’s Permanent Fund Dividend

Alaska’s economy relies primarily on oil reserves. In 1976, the state leaders introduced the Alaska Permanent Fund in order to make sure that the oil revenues are not only used by fothe Alaskarthe government expenditures but also stored to guarantee the future generations. The Alaska Permanent Fund Corporation (APFC) manages this fund. The investments that the fund does maforkesare in the form of stocks, bonds, and real estate.

Dividends from these investments are distributed annually to citizens. This process, known as the PFD, has become an important part of Alaska’s financial support system. It symbolizes shared prosperity, citizens’ participation in the state’s wealth, and financial assistance in times of need.

In 2025, the program is continuing its traditional contribution through a $1,702 stimulus payment.

2025 Payment Structure included in the $1,702?

The $1,702 stimulus payment is distributed in 2025 to include both the regular dividend and additional support for rising energy costs.

$1,403.83 – Regular Dividend

$298.17 – Energy Assistance Bonus

This combination aims to provide families not only the benefit of oil income but also relief from rising heating and energy bills during Alaska’s long, cold winter season.

Although the size of the dividend paid annually varies according to the market situation and the state budget, the payment of 2025 is an attribute of stability and further assistance.

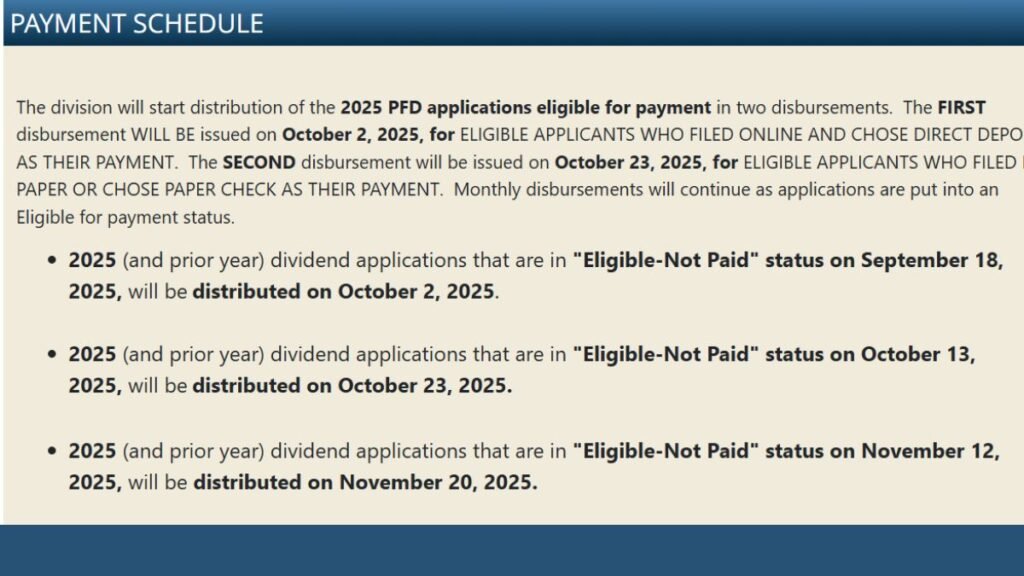

October 2025 Payment Schedule

The $1,702 stimulus payment is distributed according to a clear and systematic plan. The Alaska government has released a detailed payment schedule:

August 21, 2025 – First installment for applicants with “Eligible – Not Paid” status.

September 3 to September 18, 2025 largest wave of direct deposits.

September 11, October 2, and October 23, 2025 – Addition payments via check and direct deposit.

Senior citizens and families who use direct deposit receive payments faster than paper checks. Therefore, setting up direct deposit in advance is extremely important.

Eligibility Rules

Not everyone is automatically eligible for the $1,702 stimulus payment. The Alaska government has set strict rules to ensure that benefits only reach eligible citizens.

- Residency Requirement: Applicants must live in Alaska for the entire year of 2024 and intend to stay permanently.

- Physical Presence: Applicants must spend at least 72 consecutive hours in Alaska in 2023 or 2024.

- Permitted Absence: Absenc Additionalbsenceses exceeding 180 days can only be for valid reasons such as education, medical treatment, or military service.

- Criminal Record: Restrictions Absences anyonene convicted of Anyone multiple misdemeanors in 2024 is ineligible.

- Application Deadline: applications must be submitted by March 31, 2025. Late applications will not be accepted.

Every person, including children, must submit their application in person.

How to Apply for the $1,702 Stimulus Payment

The application process is designed to be simple and accessible, especially for older citizens who may be less likely to use digital devices.

- Visit the official website – pfd.alaska.gov.

- Login pfd.alaska.gov into myAlaska account inLog ine you do not have one, create it.

- Complete the application form fill personal information, residential address, and banking information.

- Upload Supporting Documents,Documents. In case you were absent in Alaska temporarily, you are to submit evidence of a valid absence.

- Send the application Check Documents the information carefully such that the payment is not stalled by any errors.

- The applications will be received during the period between February 1 and March 31, 2025.

Justified Reasons of for check Delays in Payments.

Many applicants eagerly await their $1,702 stimulus payment, but some common mistakes can cause delays:

- Not submitting the application on time.

- Entering incorrect or outdated banking information.

- Not providing information about living outside of Alaska.

- Uploading incomplete or incorrect documents.

It is therefore important to carefully review all details before submitting the application and to keep bank and address details updated.

Updating Bank and Address Information

- Changes in your location or banking details after submitting your application must be updated by August 31, 2025.

- If you are applying online, then you can update your details through the myPFD portal.

- If applying offline, complete the official “Address Change Form” or “Payment Method Form” and submit it on the PFD website.

These changes are not accepted via phone.

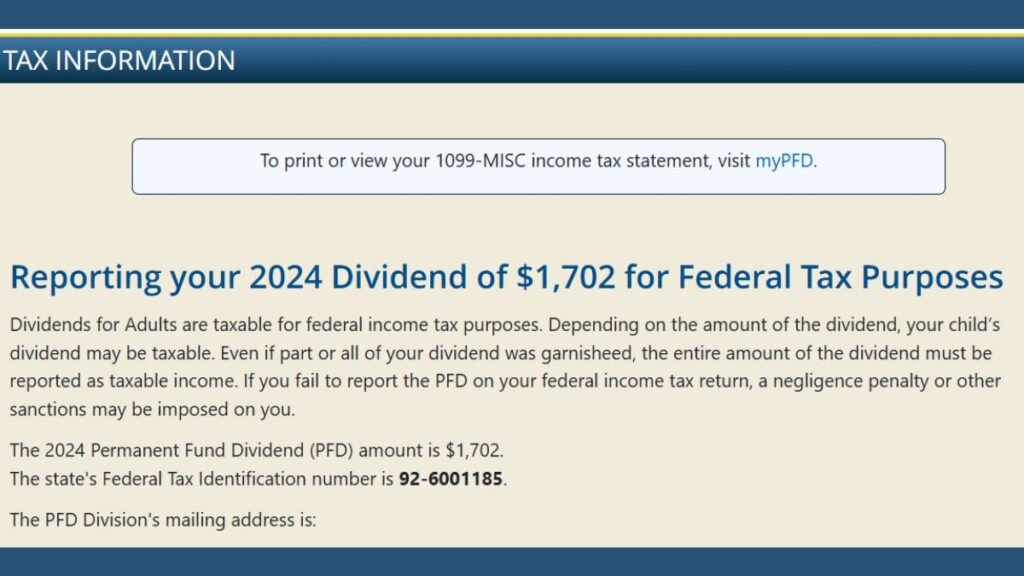

Tax Information the $1,702 stimulus payment taxable?

Alaska state does not tax this payment, although the payment is federally taxable income. This would imply that you have to claim this amount on your federal tax return in 2025.

Tax analysts suggest that one should plan in advance and make changes in withholdings. It can be helpful to hire a tax advisor particularly when the person is old.

What will become of you when advisor, do not submit the application in time?

You will miss the 2025 stimulus payment of 1702 dollars unless you apply by March 31, 2025. The following payment will be realized in 2026.

This is to point out the significance of prompt application. It is recommended that seniors and families apply in time.

Seniors and Families Relief in Alaska.

The stimulus payment of 1702 dollars is not a dividend payment but a lifeboat that assists families and seniors, tsniors too remain financially stable. Increased living standards, energy costs coseniors tosts,and health care costs have strained the household finances.

This Alaska policy is such that the state nstcosts,ate’satural resource wealth is directed to citizens directly. The payment is a relief and dignity to senior citizens especially, as they are in a position to meet their bills without worrying.

Reviewing Address and Banking Information.

- Provided that you want your address or bank details changed after having submitted your application, this should be done before August 31, 2025.

- You can update information using the myPFD portal postate’srtal,which is available in case you are online.

- In the case of offline application fill the , portal,fill outofficial address change form or payment method form and upload the form on the PFD web sitewe, fill outbsite..

- It does not welcome these changes through phone.

Information the stimulus package of 1702 taxable?

- This payment is not subject to any taxes on the part of the state of Alaska,however, according to the IRS, such payment is federally taxable income.

- This implies that you will need to reflect this figure in your federal tax returns in the year 2025.

- According to tax experts, one should plan in advance and change withholdings. A tax advisor, in particular, olpaAlaska;rticular forder citizens, can be a good idea.

What will become of you in case you fail to meet the application deadline?

Failing to do so by March 31, 2025, will prevent the payment of the $1,702 stimulus payment in this year. The second ininstallmentparticular forwill be received in 2026.

The timeliness of application is emphasized by this rule. It is recommended that seniors and families shply in time.

Seniors and Families Relief in Alaska.

The payment of the stimulus,simulus, which is 1,1,702,is not a dividend: it is a cushion that will help to keep families and seniors afloat. The rising cost of living, cost of ututilities,nd healthcare costs have stretched the domestic budgets.

The Alaska policy ensures the citizens direct benefit of the natural resource abundance of the state. This payment is a relief and dignity in the case of the seniors, at least, as they can attend to the expenses they inincur withoutny strain.

Banking and Address Information: update.

- Should you switch your address or bank details since the time you submitted your application, then do so before August 31, 2025.

- You have the ability to update information on the myPPD portal in case of an online application.

- In the offline application, fill out the official form for address change/payment method and submit it on the PFD website.

- These modifications cannot be taken over the phone.

Tax Information: Does the stimulus payment of 1702 dollars count as taxable income?

The state of Alaska does not impose any tax on this payment, yet this payment is considered a federally taxable income by the IRS. This implies that you will have to declare this sum on your federal tax return in the year 2025.

Tax experts suggest that one should plan the future and revise withholdings. It can be good to consult an advisor on tax matters, particularly for older citizens.

What is your problem with the deadline to apply?

Otherwise, you will not get the $1,702 stimulus payment this year because you have not applied before March 31, 2025. The following one will be paid in 2026.

This rule emphasizes the need for a timely application. The elderly and families are encouraged to make applications in time.

Conclusion: Housing relief to Alaska seniors and families.

The $1,702 stimulus check is not a dividend but rather a safety net that assists households and the elderly to stay afloat. The increasing living costs, energy bills, and medical costs have strained the household budgets.

This Alaska policy makes the natural resources wealth of the state directly distributed among citizens. This payment is a relief and dignity to the seniors, especially, as they are able to cope with their budgets without stress.

FAQs

Q1. What is the $1,702 Stimulus Payment?

A. It is an annual payment from the Alaska Permanent Fund, providing eligible residents with $1,702 in 2025.

Q2. Who is eligible for this payment?

A. Residents who lived in Alaska throughout 2024, meet the physical presence requirements, have no disqualifying criminal record, and submit their application by March 31, 2025.

Q3. When will the payments be issued?

A. Payments will be distributed between August 21 and October 23, 2025, with direct deposits processed first, followed by paper checks.

Q4. Is the payment taxable?

A. Yes, the IRS considers the $1,702 payment taxable income for federal tax purposes, though Alaska does not tax it at the state level.

Q5. How can seniors apply for the payment?

A. Applications can be submitted online through the official website pfd.alaska.gov